FORM 2290

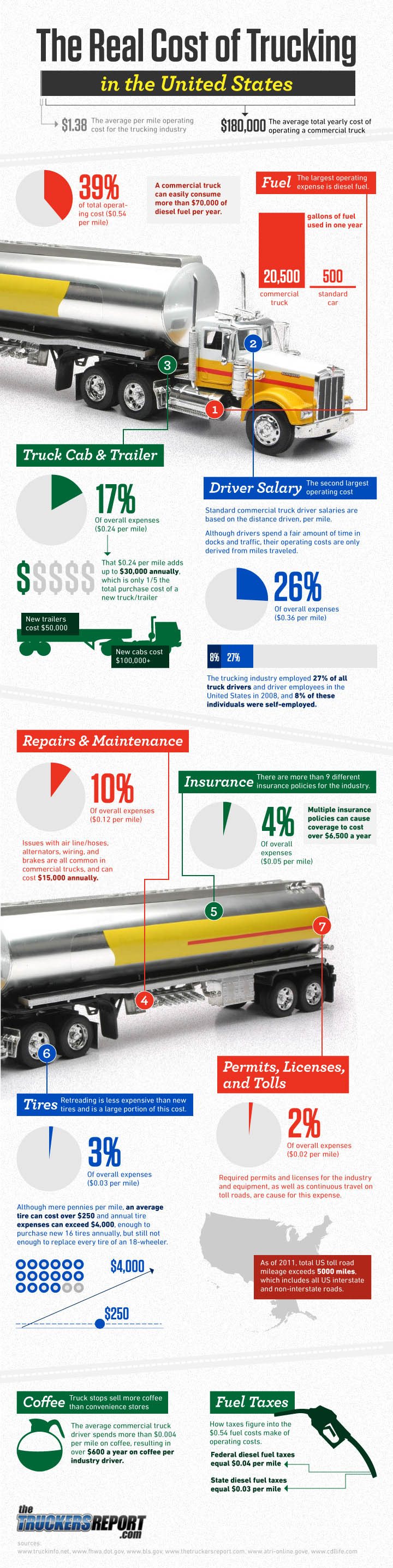

Highway Heavy Vehicle Usage tax has to be paid annual or at time of purchase of new vehicle.

To be sure you are in compliance and error free; the DOT Doctor can handle this form for you or you are welcome to the free download.

Forms and tax filing can be tricky. Let the Professionals at the DOT Doctor be of assistance.

We will fill out your forms and file them for you.

We offer record retention. Never loose a copy of your form again with our record retention services.

Form 2290 replacement is $57 and up to 12 weeks of waiting. With our fill, file and store service; we will take care of all your needs for $35/year. A copy of your form will be made available for you, upon request, within 1 business day (usually less). Sign up today!

Protect yourself with our Auto renewal annual service contract and save money.

Choose from 3 year and 5 year terms.

3 years @ $33/year

5 years @ $32.50/year

Data Collection for E-Filing of 2290

When purchasing our service; we will need you to Click here to download a spreadsheet.

Save the spreadsheet in your computer. Then open the file directly form your computer and follow the instructions below complete it.

Paste or type your data for the other forms into the spread sheet.

Please note that you must have a Key number, which starts on zero. Code 500 is your VIN, 520 is the weight of the vehicle, 510 is the category. Code 530 is option a. Vehicles Except Logging, and code 540 is option b. logging vehicles. Please an "X" on the column to make your selection. Code 550 will be filled automatically according to the answers on the web site. You can only have one date placed in service for filing. (We will assist you in filing out this form if you have questions)

For customers with less than 10 trucks; we will fill this out for you at no charge. If you need us to fill this out and have more than 10 trucks, contact us for pricing.

Number the rows from 0 to 100. One ROW is one truck. Do not change the column headings. Each column is one field, such as name, address, city, state, zip, amount etc.

Click on SAVE and save the file as a CSV file;

Then submit this file to us with your payment for filing services or email it to us after you have made your payment for filing services. Be sure the file is named with your Company Name and saved in .csv format not .xls. Additional information will be collected to complete the filing such as EIN, DOT Number and method of payment for taxes. Currently $550 per vehicle.

Tax year runs from July 1 to June 30 not January to December.